Market Update 2026

by Sunburst Investment Committee

Market Recap 2025

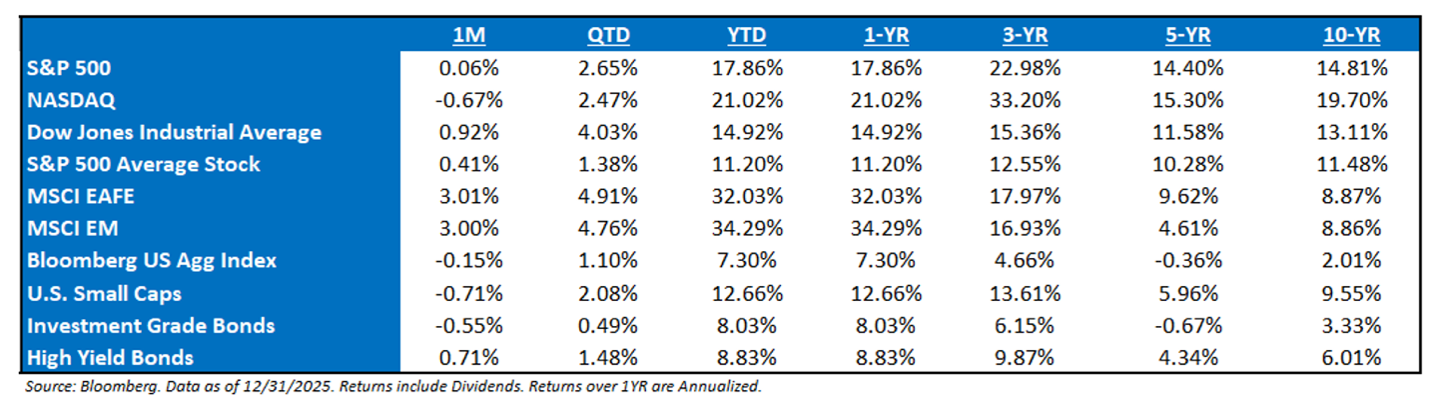

The markets in 2025 delivered strong performance across global equities, with major U.S. indices achieving a rare third consecutive year of double-digit gains, driven largely by continued enthusiasm and investment in Artificial Intelligence (AI). International equities- both Emerging Markets and in the EAFE (Europe, Australia, Far East) region- demonstrated strong relative performance, outperforming U.S. equity markets. While growth stocks continued to lead in the U.S., value stocks outperformed in most of the international developed markets. Bonds and precious metals also saw significant positive returns.

Overall, 2025 proved to be a great year for investors. However, the path was notably more volatile than headline returns suggest. Markets experienced multiple pullbacks during the year, including a drawdown of more than 20 percent between February and April. The volatility was largely due to policy and geopolitical tensions.

The first half of the year was heavily influenced by trade concerns, as the U.S. increased tariff rates to their highest levels since the 1930s. This triggered a sharp but short-lived selloff in risk assets. Despite heightened volatility and negative headlines, a strong earnings season helped restore investor confidence, allowing markets to recover and rally to new highs.

In the second half of the year, attention shifted to the positive impact of fiscal and monetary stimulus. Renewed risk-on sentiment fueled an impressive “everything rally,” making 2025 the first year since the pandemic in which all major asset classes delivered positive returns.

Bonds

The bond market in 2025 delivered its strongest performance since 2020, driven by falling yields and a Federal Reserve policy interest rate cut of 0.75%. The Core U.S. bond benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 7.3%. Bonds benefited from both price appreciation and attractive starting yields. Returns were supported by resilient economic growth and low default rates. This year saw a normalization of the yield curve, with long-term yields settling in the 4-5% range.

Key takeaways

2025 was a positive year for investors but reinforced a few lessons:

· Diversification matters: Exposure across regions, sectors, company sizes and asset classes is important. The strong performance of international markets is a great reminder of why diversified portfolios help manage risk and capture opportunities.

· Investing in structural themes pays off: Staying invested in growth drivers, such as artificial intelligence and productivity-enhancing trends, proved rewarding.

· Patience through volatility: Despite headline risk, tariff discussions, geopolitical tensions, government shutdowns, and other uncertainties, equity and fixed-income markets delivered strong returns. Attempting to time every macroeconomic development risks missing significant rebounds. A disciplined, long-term approach turned a volatile year into a positive one for balanced portfolios.

2026 Outlook

As we look ahead, there is almost always a compelling case to be optimistic (bullish) and pessimistic (bearish.) As a mentor once said when discussing markets, “pessimists tend to sound smart, but optimists make money.”

It’s easy to be excited about the incredible advances in artificial intelligence, while also being cautious of the rising market valuations driven largely by the same AI-related stocks. In this outlook, we aim to discuss these perspectives by addressing a few of the risks and opportunities ahead.

opportunities

· Continued monetary stimulus from Federal Reserve interest rate cuts

· Beneficial fiscal stimulus through tax cuts, targeted incentives, and reshoring initiatives

· Increased private-sector investment, particularly AI-related capital expenditures

· A more favorable regulatory environment driven by deregulation

· Strong earnings growth and margin expansion supported by productivity gains and operating leverage

Potential risks

· Elevated volatility around the mid-year election cycle

· A potential break in enthusiasm for artificial intelligence and renewed bubble concerns

· Heightened geopolitical risks

· A policy misstep by the Federal Reserve, cutting rates either too much or not enough

· Signs of meaningful weakness in the labor market and a slowdown in consumer spending

Deeper Dive

Mid-term elections may introduce additional short-term volatility, as these years have historically been the most volatile period within the four-year presidential cycle. On average, the S&P 500 experiences an intra-year decline of 19% during mid-term years, compared with 12% in the other three years. Despite this higher volatility, the S&P 500 has posted positive returns in the 12 months following every mid-term election since 1942.[i] While volatility may increase, ample liquidity in the economy remains a supportive backdrop for markets.

Investors need to remember, over longer periods, the market isn’t political. Policies perceived as hindering earnings and growth will be viewed negatively by the market regardless of whether they originate from Democrats or Republicans. Keeping this perspective in mind is essential when navigating political coverage and will help us stay focused on the factors that truly drive market performance.

Concerns of asset bubbles have long influenced investor behavior, but not all booms are created equal. Historically, the most damaging bubbles were speculative and unproductive, while others, such as the late-1990s dot-com era, ultimately delivered significant long-term productivity gains despite short-term pain. We believe today’s AI cycle more closely resembles the latter. Unlike past episodes of excess, AI investment is largely funded by highly profitable, cash-rich companies with strong balance sheets, robust earnings growth, and valuations well below historical bubble levels. While markets may struggle to price a technology advancing at an exponential pace and short-term corrections remain possible, this appears more consistent with temporary air pockets rather than a systemic bubble.

Instead of avoiding AI, we believe investors are best served by embracing the theme through neutral asset allocation, capturing AI-driven productivity gains while avoiding speculative excess.

Geopolitical risk is an ever-present and structural component of financial markets. There is no shortage of global tensions today. The current landscape is shaped by enduring large-scale and regional conflicts, great-power competition, and strategic economic rivalry, all of which can influence energy prices, supply chains, risk premiums, and investor sentiment. While these tensions warrant close monitoring, their market impact is often short-lived. Developments such as wars, trade disputes, regional conflicts, and political instability can create periods of heightened volatility and uncertainty. However, markets have demonstrated remarkable resilience, tending to absorb these pressures over time as underlying economic fundamentals reassert themselves.

The Federal Reserve is an independent institution tasked with achieving its dual mandate of maximum employment and price stability where long-term interest rates are kept at moderate levels. The Fed’s monetary policy decisions carry significant market implications. Easing too aggressively could overheat the economy, reignite inflation, or encourage excessive risk-taking. Conversely, keeping rates higher than necessary could slow economic growth, weaken consumer spending, and constrain business investment, increasing the risk of a recession. Given the delicate balance the Fed must maintain, missteps in the timing or magnitude of rate changes can generate meaningful volatility across equity, bond, and currency markets.

Recently, the Fed has shifted its focus from inflation to the weakening of the labor market. This shift helps explain the rate cuts implemented in 2025 and the potential for additional easing in 2026.

Recent jobs reports show modest signs of weakness and the possibility of AI-related job displacement. The surprise in the recent Non-Farm Payrolls report was the unemployment rate rose to 4.6%, in part due to higher labor force participation. This suggests more people are entering the workforce and/or looking to obtain a second job.

While the unemployment rate is trending higher and now sits above the Federal Reserve’s median dot-plot projection, it does not yet signal a systemic deterioration. Instead, it appears consistent with a gradual cooling. The market seems to be comfortable with the labor market softening, especially if it leads to further rate cuts, so long as it does not evolve into a deep downturn and systemic change to employment.

We are currently in rate-cutting cycle, providing meaningful monetary stimulus to the economy. Lower interest rates reduce borrowing costs for businesses and consumers, encouraging further investments, expansion projects and major purchases. In addition, lower rates often improve corporate profitability by reducing interest expenses and can boost business confidence, encouraging capital expenditures and hiring. This environment supports U.S. housing activity, consumer spending and overall economic growth. In addition, we expect to see a significant source of monetary stimulus to come from an expansion of the Fed’s balance sheet. Historically, Federal Reserve easing cycles that occur outside of a recession have acted as a tailwind for both stock and bond markets.

Fiscal stimulus through tax-cuts, targeted incentives, and reshoring initiatives is expected to make an impact in the first half of 2026. The “One, Big, Beautiful Bill Act” (OBBBA), passed in July of 2025, solidified and boosted tax cuts, directing billions of federal dollars across multiple industries. For corporations the bill may reduce tax liabilities. For consumers, the bill increases the State and local tax (SALT) deduction, expands senior deduction, increases the child tax credit and increases the standard deduction, among other provisions. By lowering taxes, incentivizing private investment, and supporting new spending, the OBBBA could serve as a catalyst for economic growth, potentially boosting business confidence, household disposable income, and broader market activity. Overall, U.S. consumers appear healthy and are likely to benefit further from the increased liquidity entering the market through consumer-focused tax cuts in the first half of 2026.

Private stimulus is poised to drive further growth, particularly in AI-related technologies and capital expenditures. Major technology companies such as Meta, Microsoft, Amazon, Oracle and Nvidia have announced significant AI infrastructure spending plans, reflecting a broader trend of businesses prioritizing innovation and digital transformation. Companies across multiple industries are increasingly investing in automation, artificial intelligence and advanced data analytics. Over the long-term, these investments are expected to enhance productivity, improve operational efficiency, accelerate innovation and create cost savings. Beyond technology firms, AI adoption is spreading across manufacturing, healthcare, financial services and logistics, enabling more streamlined operations and faster decision-making. As businesses modernize their infrastructure and integrate AI into core processes, these private-sector investments could support sustained earnings growth, margin expansion and broader economic productivity gains.

A more favorable regulatory environment, shaped by ongoing deregulatory efforts, has strengthened business confidence by reducing compliance costs and removing barriers to expansion. Recent examples can be seen across multiple sectors, including energy, infrastructure, semiconductors, financial services, and construction.

The semiconductor industry provides a clear illustration. Streamlined permitting and environmental review processes have accelerated the development of semiconductor fabrication facilities in the United States. More efficient approval timelines reduce project delays and capital costs, supporting higher levels of private investment. These improvements enhance domestic semiconductor production, create high-quality jobs, and strengthen the resilience of critical supply chains. Together, supportive policies and strategic investment create conditions for robust corporate performance and sustained economic growth.

Strong earnings growth and margin expansion are expected as companies benefit from operating efficiencies, technology-driven productivity gains, and operating leverage. Together, these factors support sustained economic growth and continued momentum in financial markets, creating opportunities across a wide range of sectors.

While earnings have been strong, we believe there is room for broader participation. Performance has been concentrated in the Magnificent 7 and other large technology companies.[ii] A key theme we hope to see this year is stronger earnings growth from the broader market, including companies and sectors beyond mega-cap technology. Ultimately, fundamentals drive share prices and there has been little sign of a meaningful weakening so far.

Historically, bull markets have lasted longer than many expect. Since World War II, the average bull market has lasted more than five years. While the current bull market has risen an impressive 90% over the past three years, historical context is important. The average bull market gains roughly 191%, suggesting this cycle may still be younger than it appears. [iii]

Conclusion

The lessons of 2025 reinforce that successful investing is driven by discipline, diversification, and a long-term focus. Despite volatility and uncertainty, exposure to structural growth themes and a patient approach helped balanced portfolios deliver positive results.

Looking ahead to 2026, investors face both risks and opportunities. Election-related volatility, geopolitical tensions, and policy uncertainty may drive short-term market swings. At the same time, supportive monetary and fiscal policy, continued innovation in AI, rising private investment, and productivity-driven earnings growth provide meaningful tailwinds. Caution is warranted, but history favors investors who remain diversified, optimistic, and focused on fundamentals rather than trying to time the market. [iv]

At Sunburst, we remain focused on helping you navigate these times with confidence and clarity. As always, we are committed to staying proactive, informed, and aligned with your long-term goals.

It’s not about timing the market—it’s about time in the market.

We hope you find this outlook useful, and we look forward to continuing the journey with you. As always, we welcome your questions and conversations.